College

Funding

Solutions

The Nation’s Premier

College Planning Resource.

Assisting Families for

Nearly 3 Decades.

The Nation’s Premier College Planning Resource.

Assisting Families for Nearly 3 Decades.

Client Secure Log in

Access all of your family's college planning timelines, procedures, and supporting platforms through a convenient, safe, and secure environment.

Saving 'On' College, Not Saving 'For' College

Here’s how the Real College Funding process works.

For Families with students already in high school, you may be asking how can you can accommulate the funds needed for College in such a short time?

You may not necessarily be looking to Save for college but rather Save on college. You want to save on your overall cost of college.

In short, the cost of college, and more importantly, what families actually pay, is controlled by the colleges. What other industry can you think of that bases their price on what they think they can get their customers to pay?

That’s the College Business Model – pretty amazing isn’t it?

The Business of College

College is actually three things: Essential and Expensive, which we all know about; but thirdly, "College is a Business" – 1,000% through and through. Families most often overlook, or are just not aware of this part (the most important part).

They just report what they are supposed to report, sign what they are supposed to sign, pay what they are supposed to pay, and borrow what they are told to borrow.

Does it have to be this way? No, not at all. Families can actually pay far less than the sticker price. How? They must understand the process, devise a plan, and stay on track. Unfortunately, it’s nearly impossible for most families to do this. Why? They just don’t have the resources or the time. That’s where we come in.

How we help

Colleges basically discount their price to attract the students they would like most to attend.

Colleges are investing in these students and are looking for a return on that investment – the student giving back to the school’s endowment fund after graduation, for example.

The best way to explain what happens is to think of it this way, colleges are looking for excuses not to discount their price. This may be grades, test scores, a poor essay, no volunteer work, etc. The list for the student goes on and on.

For the parents there is one glaring factor: Assets, how your assets are positioned, and how those assets are reported. Certain assets are exempt from the formulas and are not reported by the parents as an asset on the funding application forms. Our Job is to explain and help you understand the process, then help you implement a solution once you know the process.

Our role in college planning is to assist families in repositioning their assets from the funding eligibility (discounting) formulas. Few families are aware that particular assets they’ve accumulated actually disallow them from receiving funding (discounted pricing).

BENEFITS OF COLLEGE FUNDING SOLUTIONS

”Talk to us... Expertise Matters”

Contact us now and Take Advantage of our Free 2nd opinion and Financial Gap Analysis.

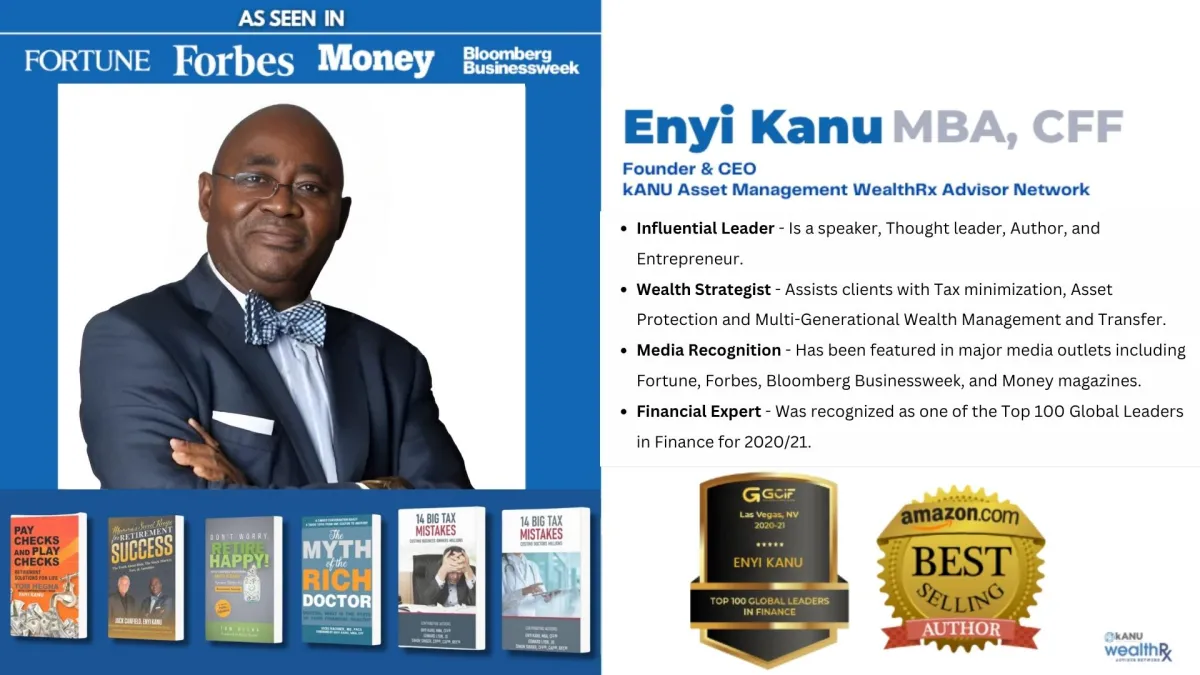

Copyright 2025. kANU Asset Management. All Rights Reserved.